About Us

Who We Are

Peter Lampert, our owner and founder, has been helping families achieve college success for over twenty years. As a CPA, he began by helping families fill out an unusual form called a FAFSA, which stands for the Free Application for Federal Student Aid. Soon after, his law degree (JD) and Master’s degree in business (MBA) led him to craft a business that not only helped families fill out the FAFSA, but also build the plan to get students to the right school, at the right price, while preserving retirement for the parents.

Over the years, he has seen what works and what doesn’t when it comes to college planning and admissions, and he is spreading the message of holistic college planning far and wide. With the right tools and the right ambition, families can see the successes that Peter’s clients have seen for two decades.

Our Team

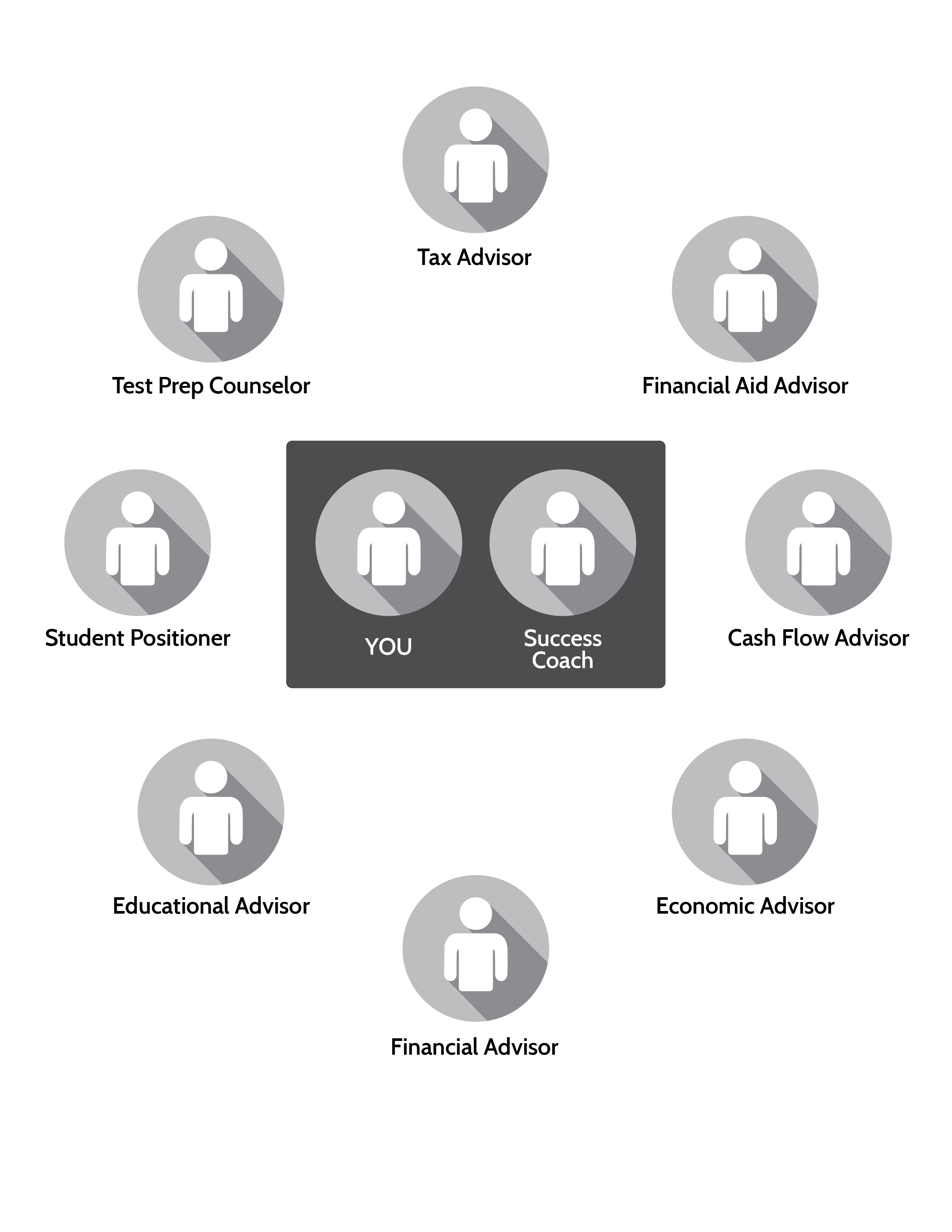

Much like an orchestra conductor harnesses each of the performers’ strengths into one melody, we enjoy pulling together the technical intricacies of the Higher Education and Reauthorization Act and the Internal Revenue Code, the maze of proper college selection strategies, and the inner workings of personal finance.

We act as a “macro-manager” to harness the strengths of our best-in-class team members on behalf of the families we serve.

You, your college-bound student, your macro manager and

- Test Prep Counselor

- Financial Aid Advisor

- Cash Flow Advisor

- Economic Designer

- Educational Advisor

- Financial Advisor

- Student Positioner

- Tax Advisor

Our Partners in Your Success

Waterford, CT 06385 and Eugene, OR 97404

For over two decades, The College Funding Service Center, or CFSC, has guided college-bound students in selecting a great-fit college and families in filing of all required Financial Aid Forms:

Selecting a great-fit college. With the CFSC, our goal is to identify 6-to-10 great-fit colleges which fit the college-bound student academically and socially and which fits the family financially.

Filing of all Financial Aid Forms. The CFSC files all required financial aid forms. This forms filing process begins with detailed Data Verification to verify the accuracy of the financial data used to complete financial aid applications. Subsequently, the CFSC completes and submits the FAFSA and CSS PROFILE financial aid forms.

Mason, OH

Lisa Marker-Robbins, founder of LEAP, and Sheri Elmore, LEAP’s former ACT-SAT Director, have developed a tutoring program that elevates students’ scores on the ACT and SAT by an average of 4.5 points on the ACT and 140 points on the SAT.

The average score increase seen by LEAP students can be achieved through their 5-session group course. Depending on the time of year, this group course can take place over 5 weeks, 5 days, or even 3 days depending on the motivation and focus of the student.

Royal Oak, Michigan

Wow’s founders, Susan Knoppow and Kim Lifton, bring decades of experience in strategic communications to the college admissions industry. They developed the Wow Method by combining Kim’s journalistic training with Susan’s organization and instructional design skills.

Susan and Kim have co-authored three books: How to Write an Effective College Application Essay (The Inside Scoop for Parents, Students, Counselors). They are members/affiliates of the Michigan Association of College Admission Counseling (MACAC), the National Association of College Admission Counseling (NACAC), the Independent Educational Consultants Association (IECA), and the Higher Education Consultants Association (HECA).

They write and speak regularly to high school, parent, and professional groups about the role of the college essay within the competitive admissions world.

Denver, Colorado

Tax Planning and Tax Return Preparation

Lampert Tax Services LLC works with a consortium of CPA and Tax Firms providing professional income tax preparation services and filings to individuals, corporations, partnerships, not-for-profits, trusts, estates, and other fiduciary returns. LTS offers tax return filing for federal and all state returns, as well as the ability to securely transfer tax documents back and forth between clients, tax professionals, and our firm. LTS utilizes industry leading tax software, advanced technology, and highly trained professional tax preparers and CPAs to ensure the most accurate returns possible and save our clients the most tax possible.

Our relationship with LTS permits us to coordinate tax planning and compliance with qualified tax and accounting professionals in an environment in which we can act as a macro or strategic manager on behalf of each of the families we serve.

Lampert & Associates, LLC

Denver, CO

Lampert & Associates LLC is a Registered Investment Advisor using Economic Design rather than traditional financial planning.

Economic Design

Objective: to build wealth beyond predetermined needs and goals

Focus: efficient and effective building of wealth

Attacks: wealth killers

College AND Retirement

Must paying for college compete with saving for retirement? Must parents choose among three competing needs and goals?

1.

Finding a great-fit college for each college-bound student

2.

Paying for this great-fit college and maximizing FREE gift aid, and then

3.

Protecting parents’ retirement dreams

Our goal before, during, and after the college years is to shrink the wealth-killer slice of the pie, such as tax, fees, interest, and market loss, and increase the segment that helps parents enjoy their retirement and pay for college.

The College & Retirement Approach

Targets $100,309 in FREE gift aid on average at private colleges

This FREE gift aid will permit parents and their college-bound students to focus on finding the Right College first and foremost. Each student is a unique individual with an academic foundation, talents, and dreams of their own. We place this truth at the forefront of our college planning process, and we encourage our families to do the same.

Targets $400,000 and more in additional wealth in 15 years

This additional wealth permits parents to recover from the cost of college and assure their retirement dreams. We invite families to choose: Right College. Right Price. Retirement Preserved™.

Congratulations on taking the first step in the college planning process. We are excited to be a part of this momentous time in your family’s life.

All the best to you and your college-bound student. We look forward to hearing from you!

Very warmly,

Peter Lampert, CPA, JD, LLM-Tax

Afford College

P.O. Box 372 300

Denver, CO 80237

www.Afford.College