You Saved. You Planned. You Did Everything Right…

Now the College System Is Punishing You For It.

Why are families like yours being asked to pay $80,000/year…

while others pay $30K or less for the same degree?

See how to protect your savings and cut your net cost.

- Find money schools don’t advertise

- Lower your net cost (not just the sticker price)

- Leave with a simple next-step plan

There’s a Playbook.

Colleges Use It Against You.

It can cost you tens of thousands—unless you know where the money is.

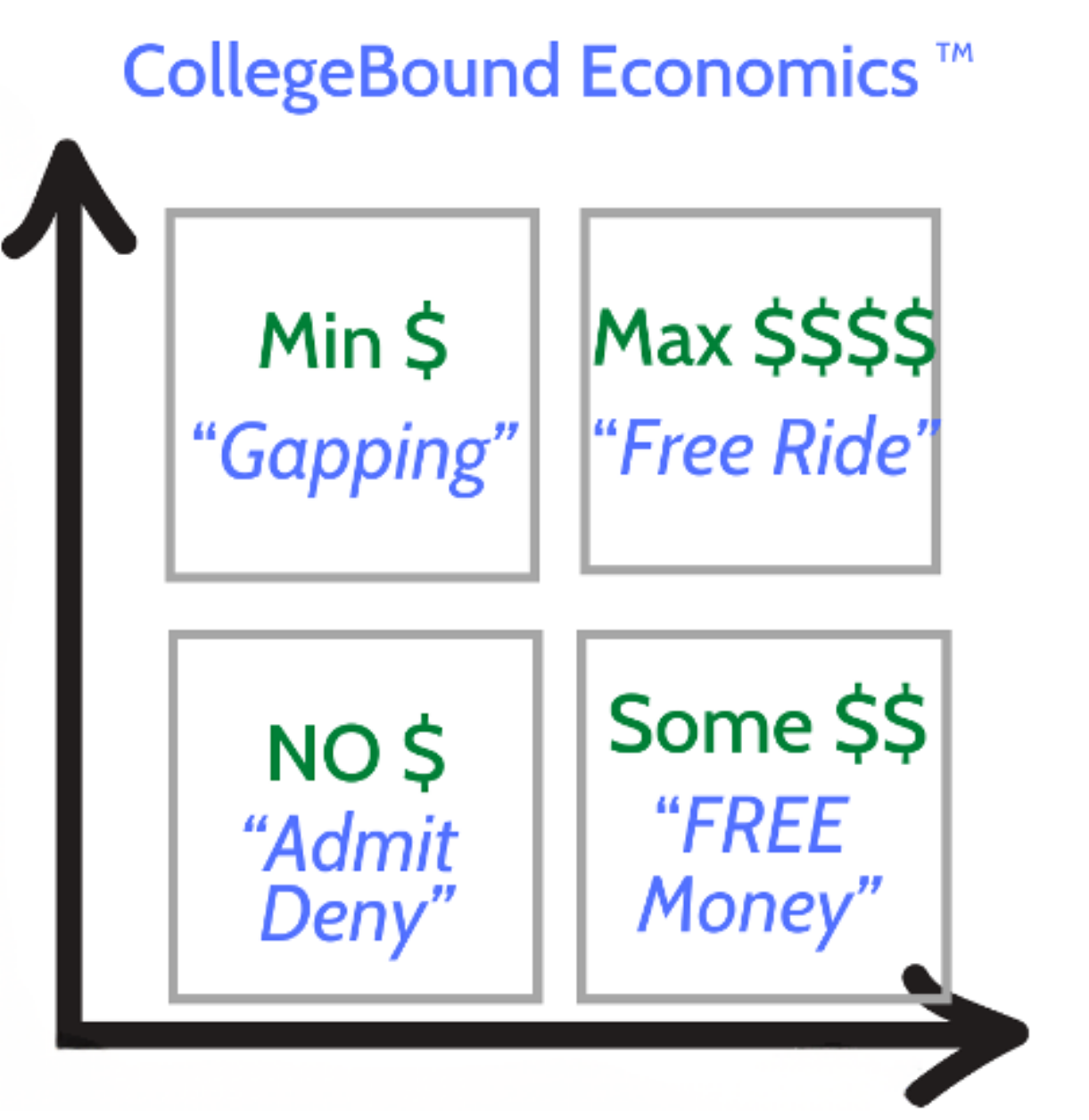

I call it CollegeBound Economics.

Most families think college aid is about income.

It's not.

Income is only one piece.

Schools use a pricing playbook to get families like yours to pay more.

I call it CollegeBound Economics.

Reported Results

This is the gap between sticker price and net cost after grants and scholarships.

Public Colleges

$34,480*

Average 4-year savings

(856 students)

Private Colleges

$107,983*

Average 4-year savings

(812 students)

All Colleges

$70,262*

Average 4-year savings

(1,668 students)

*Results vary by student and college. See FTC Disclosure below.

Want to see what this looks like for your family? Join the free workshop.

Are You in the "College Funding Gap?"

Too “rich” for aid. Not rich enough to write $80K checks.

-

Many families earning $100K–$400K get squeezed here

-

You make too much for most need-based aid

-

Paying $30K–$90K/year can wreck retirement

Here’s the fix — watch this quick video:

The 3-Step Process That Helps Families Pay Less

So you can cut net cost without draining retirement.

Step 1:

Academic Modeling

Find the schools that will pay your student.

We show you how to spot real merit money fast.

Outcome: $20k–$40k/year in scholarships

Step 2:

Financial Aid Modeling

Increase aid — legally.

Learn how schools count income + assets, and what you can do about it.

Outcome: $10k–$30k/year in additional aid

Step 3:

Retirement Preservation

Lower costs without touching retirement.

Use the right mix of school choice + timing + aid strategy.

Outcome: Retirement stays on track

Real Families, Real Results

Three case studies showing how to get FREE money for college

Case Study #1: Julie

A private college ends up being cheaper than a community college and State-U.

Case Study #2: Sarah

Negotiating for more financial aid at a private college. The final net cost was reduced to the same as CU Boulder.

Case Study #3: The Lampert Family

Securing a 58% discount at expensive private colleges.

Watch now ->

See how real families legally unlocked thousands in free money.

Click here and discover how to get similar results for your family:

What You’ll Learn in This Free Workshop

Cut your net cost without draining retirement.

- Why "sticker price" is not what most families pay

- Where schools hide grant and scholarship money

- The FAFSA/CSS mistakes that quietly raise your cost

- How to protect savings, assets, and 529s

- A simple next-step plan based on your family’s numbers

Colleges Are Targeting Your Wallet!

-- as reported May 2025 in the New York Times

If your family earns $150K or more, you might feel stuck—too "rich" for aid, too smart to overpay.

Now, it’s confirmed: The New York Times reports colleges are profiling families like yours before you even apply.

They’re not just reviewing applications; they’re using algorithms to decide what to charge your family.

Watch Now ->

Meet Peter Lampert

CPA, Tax Attorney, Fiduciary Financial Advisor, and College Affordability Specialist who’s helped 34,000+ families save $70,262* on average using legal strategies colleges hope you never learn

What parents say after the workshop

Real feedback from real families.